135) Investment knowledge is Crucial

You must have heard the old saying....

Give a fish to a man and he eats for a day.

Teach him to fish and he eats for a lifetime.

Teach him to fish and he eats for a lifetime.

In the same way, money and investment is similar.

Give money to a man and he will have money for a day.

Teach him how to invest and he will have money for a lifetime.

Teach him how to invest and he will have money for a lifetime.

Warren Buffet is one of the Greatest person alive with investment.knowledge. He realized the importance of investment from very young and is spending his life doing investment. His knowledge is being shared and had created many good investors.

Please note that Investment is VERY DIFFERENT from Trading.

Investment is for the long term, while trading is for short term.

Please note that Investment is VERY DIFFERENT from Trading.

Investment is for the long term, while trading is for short term.

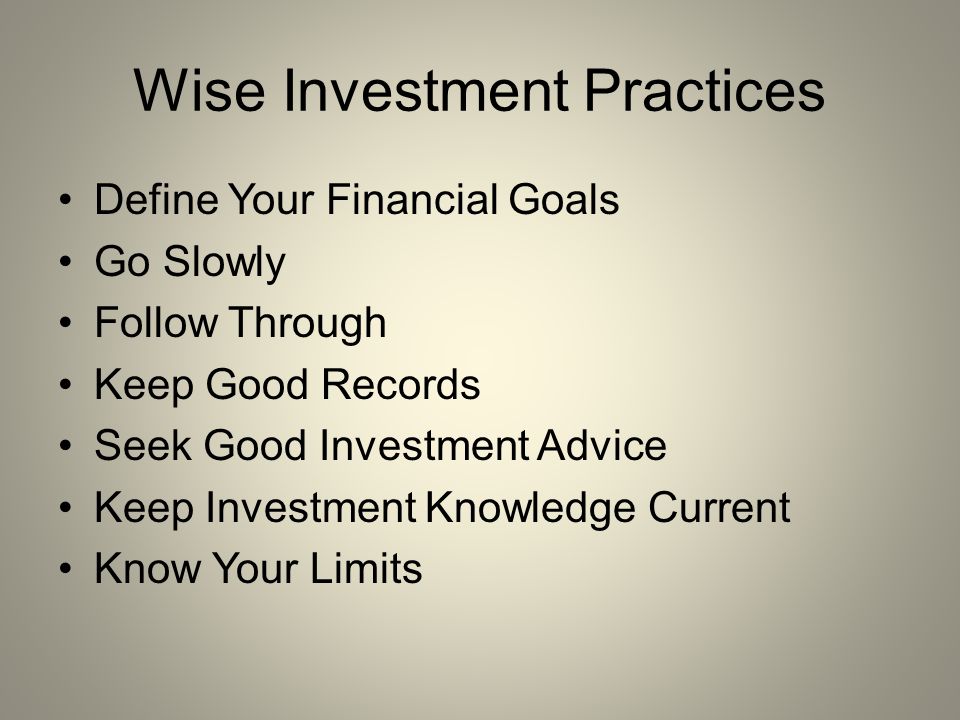

Investment knowledge is just like any other knowledge. You can learn it. With the proper knowledge, you will be able to seek the right opportunity and take advantage of situations.

When there is stock market crisis, companies stocks will be at a much cheaper price. The companies shares dropped a lot. Companies that are good and have a strong businesses, will survive the downturn. The product and services will still be needed and required by many. The business of good and stable companies will still continue.

Do you think the banks, utilities, telecommunications, basic food and milk companies will close? Their products are required everyday. Just imagine how your life will be without your hand phone, food, water and electricity.....

Total disaster right?

So, do take time to learn as much as you can about investment. Knowledge about investment is the main knowledge of the richest people alive today. All of them have shares of their public listed companies.

There are many smart people, but may not be the rich. They may know a lot about science or art, but without the investment and financial knowledge, they may not have much money. Many rich people got into financial problem because they do not have the right financial and investment knowledge.

As per quotation from Benjamin Franklin above, An investment in knowledge always pays the best interest. Just imagine what benefits you will get when you

Invest in Investment Knowledge.

If you want to know about investment knowledge, you can google or join investment classes.

Alternatively, look for a Financial Consultant and request him or her to share the investment knowledge.

It will be better if you join them and learn directly from their team.