99) Investor Challenge # 8 - What to Consider in Investment

This is a very common question. You want to know what to consider before investing. As this involves your hard earned money, it is important to find the answers to this question.

There are many things to consider, and the list below helps to answer the main questions.

1) One factor to consider is the

Purpose or Objective of the investment.

a) Is it for your child's education fund?

b) Is it for your retirement use?

c) Is it for your down payment to buy a new house?

There can be many purposes, so list all of them to have a clear overall picture on the objectives.

2) Once you know each purpose, you need to know the total

current amount required.

a) Is it $50,000?

b) Is it $100,000?

c) Is it $500,000?

Remember to multiply the number of study years if it is for education fees..

3) Another important factor is the

duration or time horizon.

a) Is it for short, medium or long term financial needs?

b) How many years to reach to required objective?

c) Can the purpose date be adjusted later or earlier?

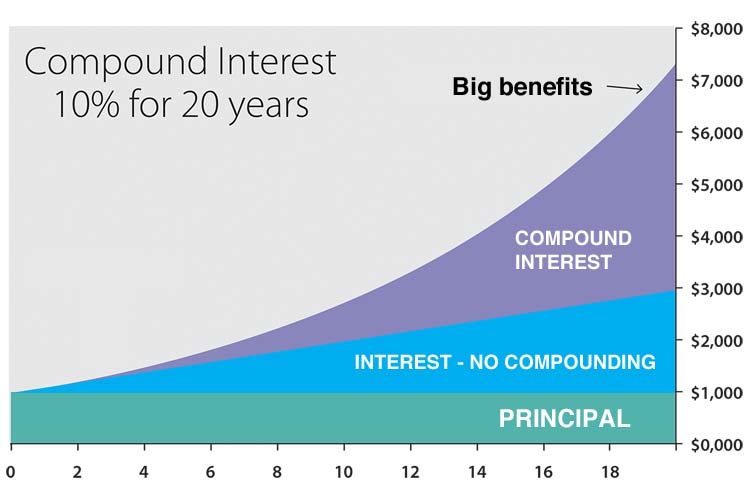

The longer time you have, the less you need to invest regularly.

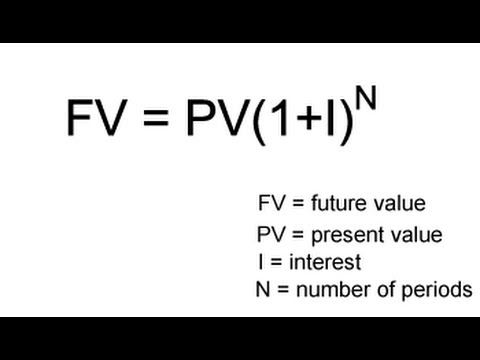

4) When you have the amount and duration, you can

calculate the future value. This is because of inflation, prices will increase over time.

a) What are the inflation rates?

b) What is the total future value?

Please note that different requirement will have different inflation rates. For example, education fees inflation will be higher than living costs inflation.

5) Also, do consider about

Risks you can tolerate.

a) How volatile is the investment returns?

b) Can you stay calm in the volatile market?

c) Will you take advantage of the price fluctuations?

Return and Risks exist in all investments.

The investment types you chose have different returns and risk. You cannot eliminate the risks.

Just learn to manage the risks. No risk means no returns.

6) Now, you need

a plan to achieve your Purpose or Objectives.

a) What is the expected investment returns?

b) How much is needed to invest regularly?

c) Can you do a lump sum now?

d) Can you increase the amount later?

e) Do you have a plan to achieve your goals?

f) How often you need to review the investment?

Do have a plan to achieve your goals and review the Target vs Actual performance.

Here's a link to read more about an Excel file to track the Target and Actual progress.

http://highlevelrules.blogspot.my/2017/06/investment-growth-target.html

Having the information and plan above will greatly help you in your investment strategies.

You can consult your professional financial consultant to calculate the total future amount. Your consultant can also advise you on the monthly regular investment amount required to achieve each objective or goals. Repeat the whole process for each goal.

You should start investing as young and as early as possible and only withdraw the investment when you need the money for the intended objective. Do not withdraw the money for not its purpose. Doing that will only affect the end result of the investment.