100) Investor Challenge # 9 - How Long To Stay Invested

This is a very common question. Investor does not know how long to keep invested. Everybody wants fast money. In the 4S of What Investor wants, this S is for Speed.

Click this link if you want to know more about the my idea of the 4S of investments.

As mentioned by the genius Mr Albert Einstein,

"Compound interest is the 8th wonder of the world."

The best is to stay invested as long as possible. This is because investment needs time to grow. The longer the investment time, the higher will be the return.

You should keep invested until you need to use the money in the future.

This is also known as the Investment Horizon.

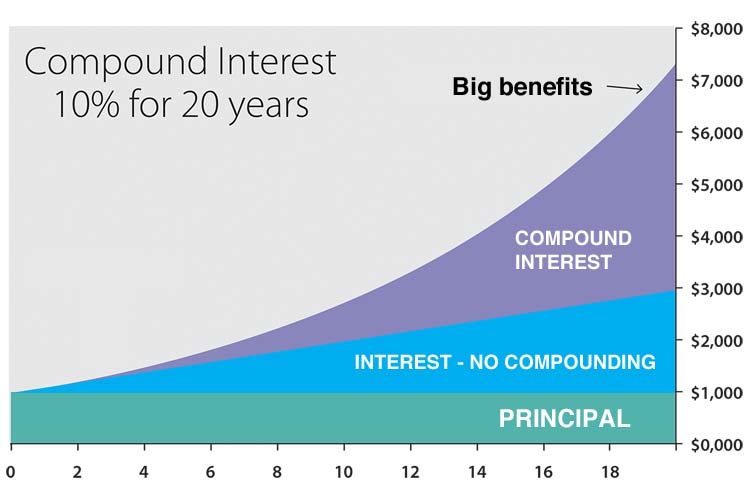

Graph below shows the differences between 10% Simple Interest & Compound Interest of $1000 over the years. Money value increases faster over time. It is the interest on interest earned.

There are strategies to handle the risk and return of each investment.

If the time horizon is many years to go, you can invest in more aggressive investments. Aggressive investments normally gives higher return, but comes with more risks.

When the investment objective is many more years to go, you have more time to manage the investment. You will be able to wait for any market crash to recover back. If the market is good, then the compounding effect will increase your money faster.

If the time horizon is nearer, then you should be more conservative in investment. Choose investments that are more stable and has less return fluctuations. However, these more conservative investments also gives lower returns.

There is a saying,

High Return, High Risk.

Low Return, Low Risk.

It is better to have a lower return than to lose the money if the market suddenly turned bad or crashes.

It is important to keep in mind on when the money is needed to pay for the investment objectives.

There are no hard and fast rules.

It depends a lot on your risk level, investment objectives, market conditions and many other factors.

Your professional financial consultant will be able to advise you.

No comments:

Post a Comment