170) What are the Benefits of Dollar Cost Averaging?

What is DCA?

Dollar Cost Averaging (DCA) simply means buying an investment with a fixed amount of money on a regular schedule over a long term, regardless of the price.

For a share or equity investments, the prices are volatile. The prices go up and down depending on the economy and market conditions. Investors want to buy at the cheapest price. Buy at the lowest price and sell at the highest is an easy concept to understand.

Simply put, Buy Low and Sell High.

It is easier said than done. Below is an example of a company share price movement for the whole of 2016.

It is easy to spot the highest and lowest price for a past event. Who can tell what are the price directions in the future?

It is very difficult to predict the price movements. When a stock price has gone up, it can go even higher. After go higher it can turn back down or go even higher. Trying to find the best time to buy is called market timing.

Many times, while trying to time the market, investors did not start investing at all.

They just could not find the right time.

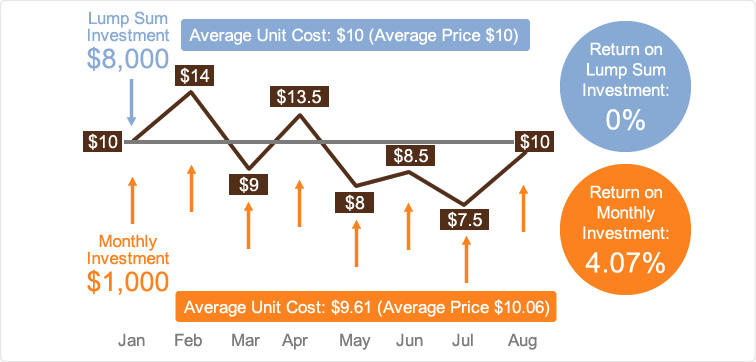

Refer to the graph above for a case study. You had bought lump sum $8000 at $10 in Jan. You have a total of $8000/$10 = 800 units. Your investment is still $8000 when the price is back to $10 in Aug. The total return is 0%.

DCA is used when you keep buying $1000 on monthly basis over the 8 months.

In Jan, you get $1000/$10.00 = 100.00 units.

In Feb, you get $1000/$14.00 = 71.43 units.

In Mar, you get $1000/$9.00 = 111.11 units.

In Apr, you get $1000/$13.50 = 74.07 units.

In May, you get $1000/$8.00 = 125.00 units.

In Jun, you get $1000/$8.50 = 117.65 units.

In Jul, you get $1000/$7.50 = 133.33 units.

In Aug, you get $1000/$10.00 = 100.00 units.

Total Invested = $8000. Total Units = 832.29

Average price = $9.61 per unit.

You get more units when the price is lower. You get less units when the price is higher.

By buying regular and fixed amount, the Average Cost per unit is $9.61.

You may understand about asset diversification. You can diversify and spread your investments into different assets, funds and countries.

Dollar Cost Averaging is to diversify the Market Timing.

You spread the timing into the market.

So, what are the Benefits of DCA?

1) Buy at the Average Cost. Not the highest nor at the lowest price.

2) No need to time the market. Can invest regularly all the time.

3) No stress on buying at the wrong time (at highest price).

4) Disciplined and consistent method to accumulate wealth.

5) Easier to prepare small amount for investment. Compared to difficult to get a large lump sum.

6) Easy to decide to invest. No extensive research and spend lots of time to find the best time.

7) Automatic investment via Direct Debit Instructions. No need to remember when to invest.

Now, what are the Disadvantages of DCA?

1) Not suitable for low volatility and up trending prices. Example: bond fund and money market funds. It is best if you invest lump sum immediately when the price is lower, before it gets higher.

If you do DCA, you are just buying at higher and higher prices. This is called Averaging Up.

More details in the links:

Should you do Dollar Cost Averaging with your Bond Fund?

http://highlevelrules.blogspot.my/2017/07/should-you-do-dollar-cost-averaging.html

Time In the Market vs Timing the Market.

http://highlevelrules.blogspot.my/2017/10/time-in-vs-timing-market_24.html

No comments:

Post a Comment