89) Investor Challenge #5 - Investment Is Risky

There are differences between Savings and Investment:

Simply put....

Savings are SAFE.

Investments have RISK.

RISK in investment simply means the possibility to lose money.

Well, in this perspective, it is very normal for people to be fearful of investments.

Many will tell you how their so and so had lost so much from investment. Some even borrowed money from loan shark and lost everything. Now, he is hiding from the loan sharks. So many scary stories.

The recent news about the losses in money game and high return investments scams add more fear into the public's mind. It had affected the legal, valid, regulated and safer type of investments.

You have heard about the saying,

High Risk, High Return;

Low Risk, Low Return.

It is very true in business and even life.

Those in the higher risk jobs are normally paid more. For example, an engineer who works in the offshore oil field is paid much more compared to an engineer in a factory located at the Industrial area.

A small startup company has the potential to earn multiple times compared to a big and established company.

So, how do we manage the risk in Unit Trust Investments?

There are few strategies:

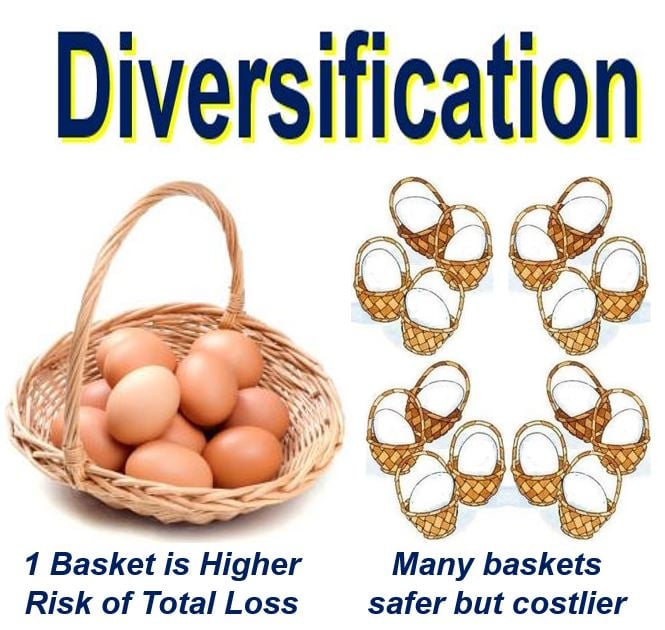

1) Diversification

As the saying, Not to put all the eggs in one basket. You diversify your investments into many varieties:

a) locations, countries, regions

b) company size - large, medium, small

c) Sectors - manufacturing, financial, property, plantation, etc.

2) Dollar Cost Averaging

Not putting all your money at the same time. You avoid the wrong timing. This means you invested at the high price and then see your investments losing value thereafter.

To do dollar cost averaging, you put:

a) same or similar amount

b) regularly by monthly or quarterly

c) over long period of many years

3) Asset Allocation

You invest into few types of investments. Different asset types will provide different risk and returns.

The asset types:

a) Equity fund

b) Bond fund

c) Money Market fund

You maintain a certain percentage for each asset types. Example:

a) Equity fund at 60%

b) Bond fund at 30%

c) Money Market fund at 10%

4) Rebalancing

As your investments grow, one asset type will give higher return compared to another. So, you rebalance back as per the original percentage.

From the example above:

a) Equity fund increase to 80%

b) Bond fund reduce to 15%

c) Money Market fund reduced to 5%

Please note that all the 3 asset types made money. Just that, in the good economic situation, Equity fund made more return than the bond fund and money market fund. Therefore, the percentage growth in Equity fund is faster.

In this case, you can rebalance back to the original ratio by percentage as below:

a) Equity fund reduce back to 60%

b) Bond fund increase back to 30%

c) Money Market fund increase back to 10%

Watch the video below on the concept of Rebalancing during stock market ups and downs.

The image below is for equal allocation (25%) for 4 asset types.

One way of looking at rebalancing is the concept of:

Buy Low, Sell High.

When the stock market had gone higher, your equity fund value will also increase. Thus, the Equity percentage also increased.

You SELL part of the equity fund (eg. 20%) when the price is HIGH.

This is to reduce the risk if the stock market suddenly turn bad.

Conclusion

All investments have risk.

Savings also have the risk of inflation.

There are ways to reduce and manage the risks of investment. For unit trust investments, you have the Unit Trust Consultants to assist in the investment process and the Fund Managers to manage your money in the investment fund.

Please be reminded and be aware that all investments have risk. Do consult your professional investment and financial consultants.

Great info sharing sir! 👍👍👍

ReplyDeleteGreat that you liked and thanks for your support.

ReplyDeleteThank you Sean for your sharing of knowledge...very helpful indeed.

ReplyDelete